In today’s rapidly evolving financial landscape, relying on traditional teller cash recyclers can leave your branch operations lagging behind. While these systems once revolutionized cash handling by automating tedious tasks, technology has marched on—and so should your strategy. This article dives into seven critical approaches to rethinking your cash management tactics. Consider these key points as you evaluate how to upgrade from outdated methods and harness modern efficiencies:

- Challenge Legacy Technology: Outdated modules limit capacity and slow down operations.

- Embrace Automation: Move beyond manual counts with self-auditing systems that boost accuracy.

- Expand Capacity Efficiently: Leverage advanced cassette-based recyclers to double cash handling capabilities.

- Promote Integration: Opt for open platforms that seamlessly work with your existing tech ecosystem.

- Reduce Costs: Take advantage of improved pricing to invest in smarter, more reliable solutions.

- Adopt a Holistic Approach: Integrate cash management within a broader, interconnected financial ecosystem.

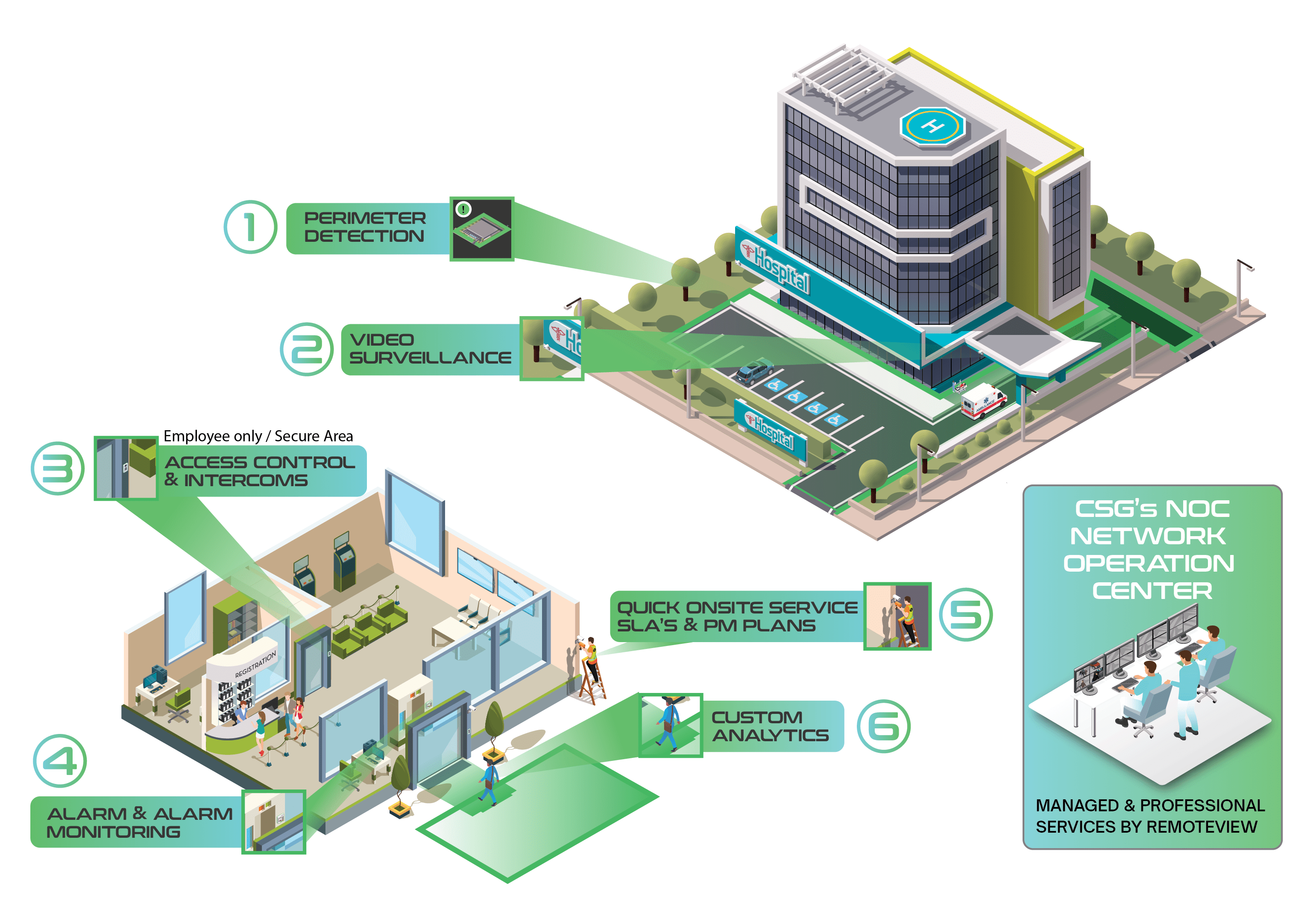

- Prioritize Security: Ensure your service provider offers robust, certified support with remote patching and threat monitoring.

Struggling with outdated, poor performing TCRs?

Many Teller Cash Recycler brands have become obsolete with limited parts. Some are even at end of life and are a security risk.

When it comes to lobby teller cash recyclers not much has changed over the last decade when they released. When implementing this technology in the branch, people often overlook the strategic possibilities of recyclers.

For years we loved the implementation of a dispenser that would replace our traditional teller cash drawer and allow for a safe and automated way to handle cash at the teller line. It helped us avoid cash counting mistakes and made the overall branch operation flow in a smoother way. When the technology advanced to full cash recycling which enabled the ability to not only dispense cash but also accept it; we felt like we arrived at the finish line!

The full circle of the cash journey in the branch was now complete with a single piece of technology! No more need for a vault, cash drawers, and time-consuming cash audits; the list of benefits went on forever. This technology has been so successful that it is very rare to find any financial institution today that doesn’t have this technology deployed. Finally, technology has caught up with the Financial Industry.

The technology caught on so quickly that it has slowly become an afterthought. If you were to pick a black hole of technology within a financial institution, teller cash recyclers would fit that bill better than maybe any other technology.

When deploying the first unit, so much planning and testing went into it. Once the rollout to the entire branch footprint was completed it hasn’t seen a second look.

To my surprise, my initial feeling was completely wrong. This technology has not stopped evolving over the years. Many financial institutions are caught in a comfortable spot but quickly get behind unknowingly.

I have 7 teller cash recycling strategies worth a re-look. I want to share some thoughts that would be worth asking yourself when looking at your current cash recycling technology to see if you are staying current.

Update your old Teller Cash Management & Recycler strategy.

Although teller cash recyclers have been around for a while you shouldn't wait to enhance your deployment strategy. We need more out of the technology we have already before we add new technology. Open platforms give you a starting chance. Cook Solutions Group can help you start the discussion around a vendor-agnostic approach that truly fits your growing needs.

Written by: Scott Fieber, Chief Strategy Officer

.png)