DISCOVER HOW MUCH EASIER AND COST-EFFECTIVE ITM IMPLEMENTATION HAS BECOME.

Nearly 14 years ago, I sat down across the table from Gene Pranger, inventor of interactive teller machines (ITMs) and video banking, interviewing for a job while completing my college education. I loved his passion for the community financial space. At the time, big National financial institutions were growing at such a rapid pace that the community financial institutions were struggling to keep up.

His vision was to find a way for these community and regional banks and credit unions to grow their footprint with a small amount of capital, without sacrificing the face-to-face interaction that makes them great, and truly differentiate themselves from national banks. Additionally, how looking at ways we can allow the existing branches to become profitable as branch traffic saw year over year declines, without sacrificing the consumer experience? I was ecstatic to join the cause and couldn’t wait to start making a difference.

Fast forward and NCR announced the acquisition of uGenius, to add ITMs as part of their portfolio. This gave ITMs the visibility and platform now to be globally recognized, among several other great resources to mature the product. Selling ITMs instead of basic ATMs posed new challenges to NCR and the world as it looked for new ways to implement this technology. Many saw the technology as a super ATM or an ATM with video chat instead of a teller platform capable of doing so much more.

Over the years competition started to arise to match the growth NCR was seeing, and those other companies clouded the strategy that was initially conceived. Market confusion and unsatisfactory deployments by these other products trying to be an ITM lead to negative reviews. Many sought to bundle the acronym “ITM” to some generic product even though the platforms varied dramatically from company to company.

After 4 years of helping to educate the market and working with financial institutions of all different sizes all across the country, I decided I needed to do more. We had to get back to the vision. We had to pause and get the process right to match a great technology the market desperately needed.

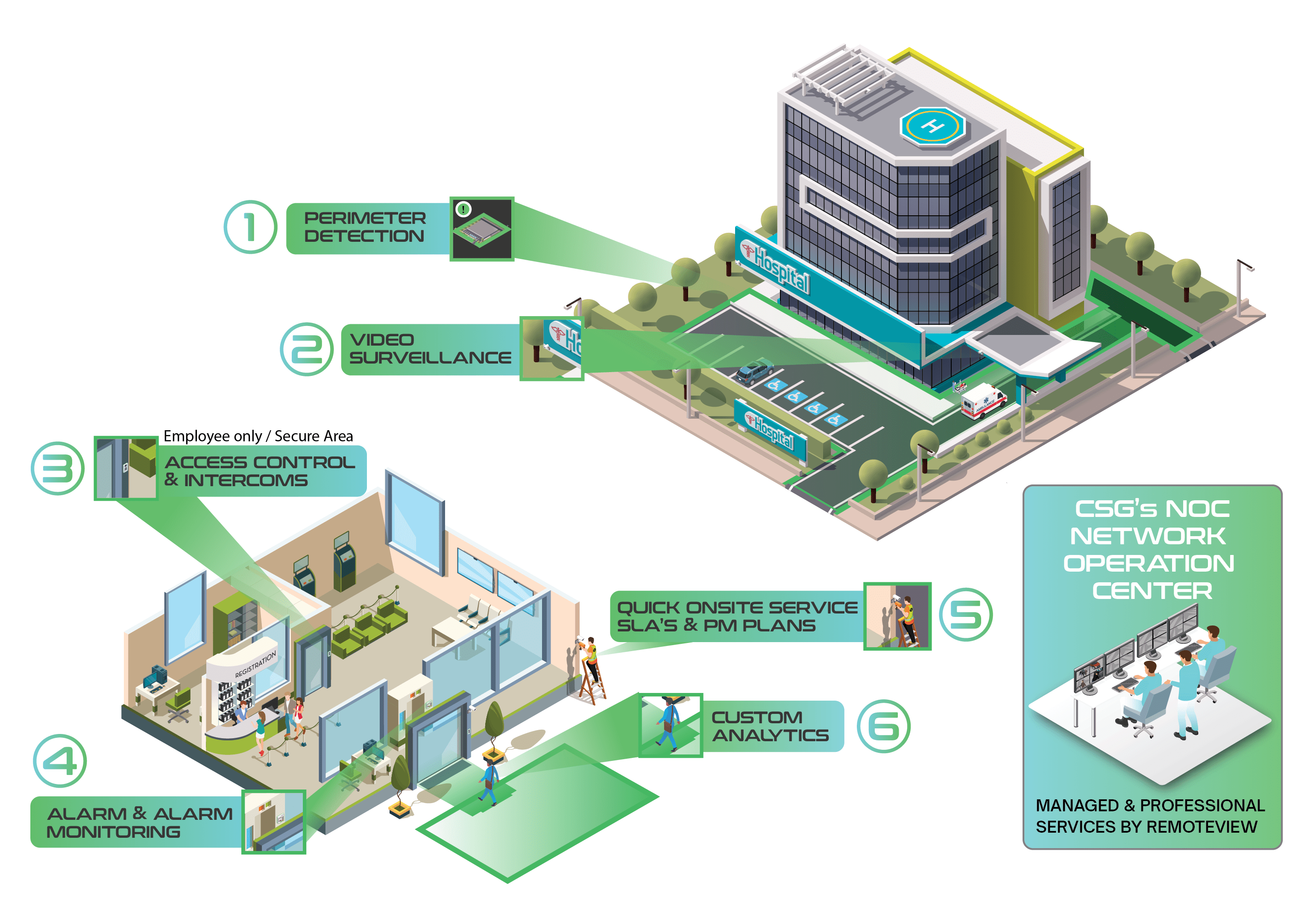

When I met Brian Cook and Randy Neu at Cook Security Group (CSG), I felt as if I was back in Gene’s office with people that cared about the experience and open to ideas of how we can take this great product even further. Here we had a recipe to partner with the manufacturers on the technology and put a unique twist around the deployment and strategy, which in turn would provide a holistic approach once again that the market deserved.

Traditional ITM branch

If the pandemic taught us anything, it has shown how valuable a solid plan around consumer engagement can be. We have also seen how adaptable your consumers are to technology that we initially didn’t believe they would adopt. Whether you have looked at ITMs in the past or have never entertained the idea, I’d suggest investing an hour of your time to educate yourself and your team on ITMs by someone at CSG. It is my promise you will be glad you did.

A quick recap:

- Host your strategy workshop.

- Identify your conversion locations and timeline.

- Execute your implantation plan.

It can be this easy!

.png)